In a crowded fintech landscape, digital storytelling has become more than a creative exercise, now it's a strategic lever for differentiation, trust, and engagement.

This article explores how leading fintech brands use interactive storytelling to boost brand awareness and user activation, and where others have stumbled. From immersive microsites to campaign misfires, we break down what works, what doesn’t, and what tech marketers should prioritize next.

1. Digital collectibles microsite by Coinbase

- Concept: Commemorating decisive basketball moments through digital collectibles during the Golden State Warriors game.

- Execution: An immersive microsite designed by Noomo Agency allowed fans to explore and "own" game-changing plays in the form of NFTs.

- Storytelling Technique: Merging fan culture with blockchain technology; the interactive site guided users through a dynamic, collectible-based narrative.

- Impact: Emotional brand alignment + increased awareness of Coinbase's crypto utility.

2. Interactive brand identity by Middle Finance

- Concept: Introducing a new financial product with a bold, unconventional brand voice.

- Execution: A highly animated, interactive website created by Noomo Agency where visitors learn about the brand through scroll-triggered storytelling and playful UI.

- Storytelling Technique: Visual metaphors and interactions made the brand feel human, innovative, and trustworthy.

- Impact: Strong brand differentiation in a crowded digital finance market.

Middle Finance interactive website

Middle Finance interactive website3. House of Y2K by Klarna

- Concept: Merging nostalgia with modern shopping to attract Gen Z and millennial users.

- Execution: An immersive digital and physical campaign featuring Paris Hilton as a virtual curator of early 2000s style, complete with virtual shopping experiences.

- Storytelling Technique: Nostalgic storytelling + celebrity culture + interactivity.

- Impact: 63% increase in app downloads and successful reactivation of a younger demographic.

Screenshot from klarna.com. Used for commentary purposes.

Screenshot from klarna.com. Used for commentary purposes.4. Humanized digital payments by OpenNode

- Concept: Positioning Bitcoin payments as approachable and business-friendly.

- Execution: A sleek, creative website made by Noomo Agency where storytelling unfolds through scroll-based animations, real-time payment visualizations, and clear, inviting messaging.

- Storytelling Technique: Demystifying Bitcoin through clean design and intuitive micro-interactions, making complex technology feel accessible.

- Impact: Strengthened OpenNode’s perception as the go-to solution for simple, secure Bitcoin transactions across industries.

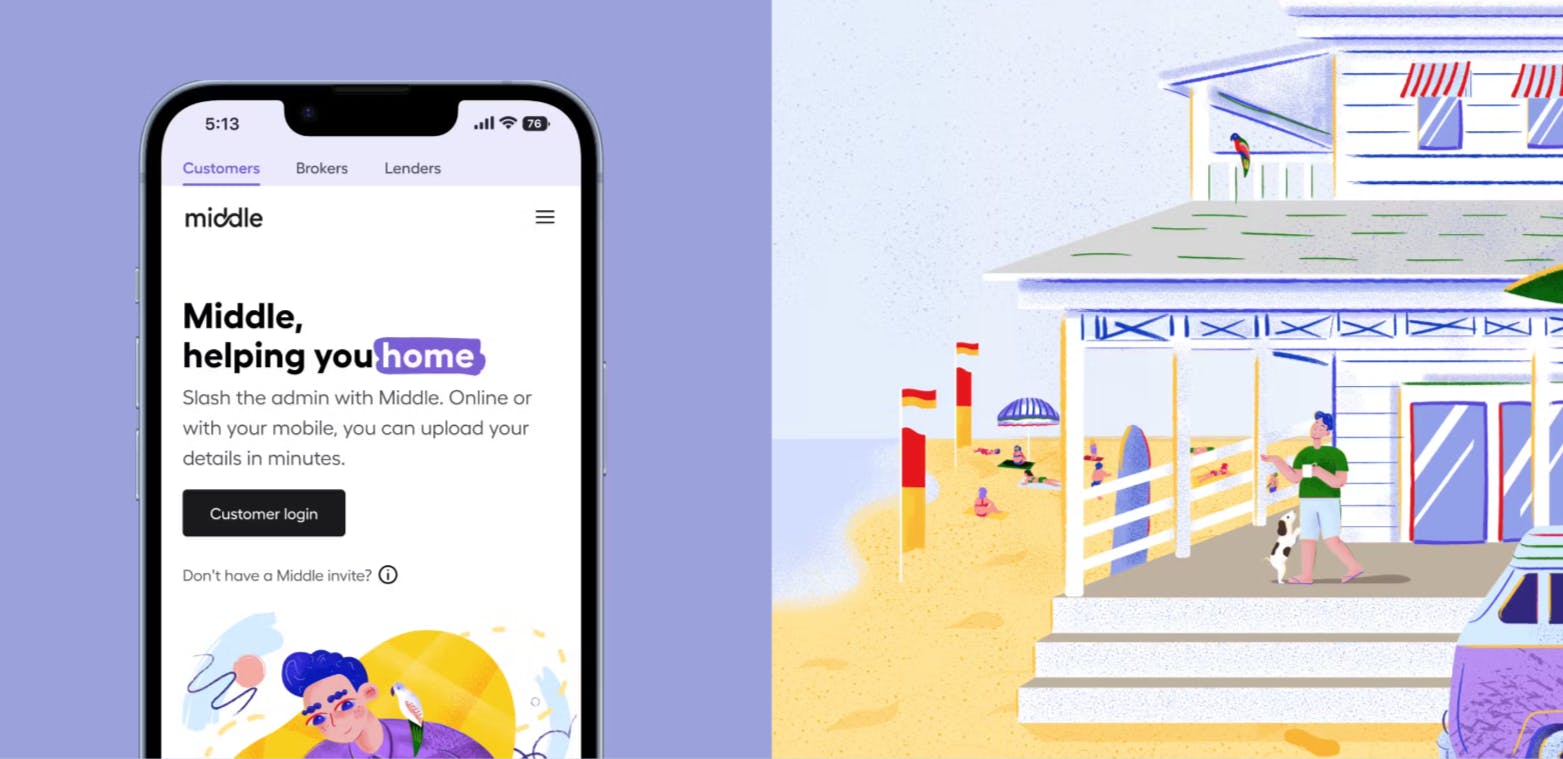

5. Gamified experience by Google Cloud & Financial Times

- Concept: Helping C-suite executives understand the importance of data-driven decision-making in building business resilience and sustainability.

- Execution: An interactive, gamified experience named "Business Resilience" where participants took on executive roles at a fictional company ("Sunrise Cereals Co.") and made strategic decisions with limited "smart credits." Each choice influenced the company's long-term success.

- Storytelling Technique: Scenario-based gameplay with intuitive navigation and illustrated storytelling, immersing users in realistic business challenges.

- Technology: Built as a single-page web application using JavaScript; featuring storybook-style illustrations and micro-animations to maintain focus and engagement.

- Impact: 25% of users were C-suite executives that matched the target audience.

Screenshot from “Business Resilience” game by Google Cloud. Used for commentary purposes.

Screenshot from “Business Resilience” game by Google Cloud. Used for commentary purposes.When storytelling backfires

Not all fintech storytelling efforts land well. While design and messaging can spark curiosity, they cannot mask foundational issues in product, regulation, or timing.

Two recent cases offer clear cautionary tales.

Zing by HSBC: good Story, weak differentiation

Launched in early 2024, Zing was HSBC’s bold attempt to win over younger, mobile-first users in the cross-border payments space. The brand positioned itself with modern visuals and a promise of simplicity. It was clearly aiming to rival apps like Wise and Revolut.

However, despite its sleek design and high marketing spend, Zing failed to offer a distinct product advantage or geographic reach. It launched only in the UK, struggled to communicate why it was better, and was quietly shut down in May, 2025. HSBC later confirmed it would fold Zing’s tech into its broader ecosystem.

Screenshot from zing.me. Used for commentary purposes.

Screenshot from zing.me. Used for commentary purposes.Takeaway: Storytelling without clear product-market fit or competitive edge is just noise.

Lanistar: hype without infrastructure

Lanistar’s influencer-driven campaign in 2020–2021 promised “the world’s most secure payment card,” amplified by thousands of sponsored posts. But beneath the flashy social push, the product wasn’t FCA-authorized at the time of launch, sparking regulatory warnings.

Though the company later addressed licensing concerns, the reputational damage was done. Claims were ruled misleading by regulators, and partners distanced themselves from the brand.

Screenshot from lanistar.app. Used for commentary purposes.

Screenshot from lanistar.app. Used for commentary purposes.Takeaway: A bold narrative cannot outrun compliance failures or overstated promises.

How fintech brands can build stronger digital storytelling campaigns

From success stories and setbacks alike, a few best practices emerge for fintech brands looking to make an impact:

Ground the story in real, differentiated value

Don’t lead with vision alone. Anchor every campaign in what the product actually does better than others and why it matters to your audience.

Design interactive experiences, not just visuals

Use microsites, progressive storytelling, or gamified UI to involve users. Don’t rely solely on ads or scroll-to-read pages. Let people participate.

Align brand story with regulatory reality

Ensure your product is fully compliant before building momentum. Nothing derails trust like a public warning from a financial authority.

Test with real users before launch

Whether it’s messaging, UX, or visual metaphors… test early and iterate. What excites an internal team may confuse or alienate end users.

Make performance measurable

Track more than impressions: measure time-on-site, scroll depth, interactions, and conversions. Good storytelling should drive clear behavioral outcomes.

The most effective campaigns aren’t just well-designed; they’re grounded in product truth, user relevance, and technological clarity. When storytelling is backed by strong design, smart interactivity, and real substance, it becomes a growth engine, not just a brand layer.

More about digital storytelling:

- The power of digital storytelling or how to tell the story without words.

- Noomo ValenTime: immersive storytelling.

- Brand Strategy for Web3: Сreate brand identity for the future.

- Crafting the Best Storytelling Website.

- Coinbase and LA Clippers: digital activation.

- How to create an engaging storytelling website: Noomo XR

- Shaping Jasmina Denner’s story through digital storytelling.